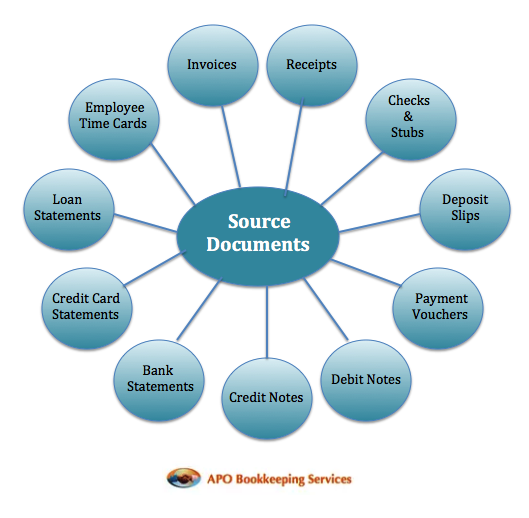

Source documents are any original financial records that serve as a paper trail to support your bookkeeping transactions. These documents may include – but are not limited to – company purchase orders, packing slips, supplier invoices, cancelled checks, cash receipts, cash register tapes, bank and credit card statements, and employee time cards.

These records are what allow your bookkeeper or accountant to prove the legitimacy of journal and general ledger entries. And while it does not really matter if your source documents exist in the form of hard copies on paper, or in an electronic format, what does matter is that:

- you’ve taken steps to set up a secure and organized system for filing and retaining your documents,

- all corresponding bookkeeping entries are made in a timely and accurate manner, and

- one of the defining factors of whatever filing system you’re using is the easy retrieval of clear, complete, legible copies of all your original documents

Scanned and photocopied receipts are generally acceptable from a tax audit point of view.

Managing Your Source Documents for Tax Purposes

According to the IRS, all your business records (meaning any documents that support “an item of income, deduction, or credit shown on your tax return”) should be kept for a minimum of two years, up to “indefinitely” – depending on the activity they support. In fact, it is a possibility that your business could be selected for a tax audit in any given year and that’s also one of the most important reasons for keeping these records readily available.

During an audit, governmental tax investigators are responsible for verifying the accuracy of income and deductions reported on your company’s tax returns. Because this is typically accomplished by examining a representative portion of your accounting transactions, part of the auditor’s investigation will also include scrutinizing related source documents.

Wherever possible, your source documents should include:

- the dollar amount of the transaction involved,

- the date it occurred,

- who participated in the transaction, and

- why the transaction was made

The period of time prescribed for document storage by the IRS does more than just aid their assessment of additional taxes down the road. Storing your files appropriately also allows your business to amend previous tax returns to claim refunds or credits that might have been missed.

More Benefits of Good Record-Keeping

Keeping your source documents, accounting records, and other financial paperwork available for future reference extends beyond your tax obligations. It also forms part of a smart business strategy. The review of your company’s records plays a key role in any business audit – including the ones that typically accompany an acquisition, merger, or sale.

It’s important to think about your accounting activities as part of a much bigger infrastructure. Every bookkeeping transaction your company engages in – and every source document involved – helps lay the foundation for accurate financial records, and thus accurate reporting.

Should you ever reach the point where it makes good business sense to join forces with another organization – or to leave your company behind altogether – you’re far more likely to meet your objectives if your records are intact, up to date, and accessible.

Let’s say your long-term strategy includes an exit plan that revolves around selling your business. It only makes sense that potential buyers will want to find out as much as possible about your company’s finances. In fact, a huge part of the commercial sales process includes opening your books to interested parties so they can investigate your profit history and forecast future revenue.

Among other things, this process could involve examining your company’s:

- past tax returns,

- assets (both tangible and intangible) and liabilities,

- cash flow projections, and

- profit and loss statements

The inherent value of these types of business records stems directly from your bookkeeping habits. The more stringent your company’s accounting standards are over the years, the more useful these records become.

The last thing you want as a business owner is to miss out on a viable opportunity – planned, or unplanned – because you failed to keep your financial house in order. Source documents – and the records they are a part of – are instrumental in the creation of financial statements and reports that help you to make good business decisions.

So rather than feeling frustrated or becoming irritated next time your bookkeeper hounds you for that missing receipt, remember that helping your accounting professional perform their job better is a solid investment in your company’s future. It is to ensure both you and your bookkeeper are on par with the numbers you are compiling and they are inclusive and accurate.

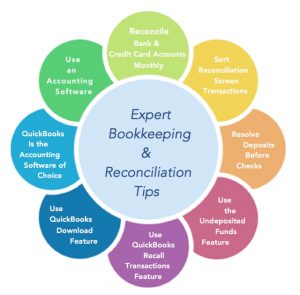

If you are looking for exceptional bookkeeping services in New York, APO Bookkeeping has you covered. We streamline your bookkeeping processes, ensuring that everything is kept updated, manageable, and above all, effective. Let’s have a chat—reach out to us today to learn more.

Oh my goodness! I use to be so annoyed when my bookkeeper kept asking me for “source documents” after I sent her my spreadsheet and other notes I had. She wanted my bank statements, credit card statements, loan docs and even receipts sometimes. It felt invasive and I would take forever to send it. LOL! I was terrible. But it was not until I attended a business retreat and was speaking with a few fellow business owners – of which two were in the bookkeeping business, that I realized they were doing their jobs of verifying the information for themselves. And yes, my bookkeeper did explain somewhat why she wanted them, but I was skeptical and very resistant.