by Eugénie M. Nugent | Aug 16, 2016 | Business Improvement, Financial Reports

Backed Up Bookkeeping Update

Are you a small business owner trying to manage all aspects of your business on your own?

Have you fallen behind with your bookkeeping?

Do you find that your bookkeeping tasks are taking the passion out of your business?

Do you pull your hair out every time you think about keeping the books? (Well, not literally, I hope)

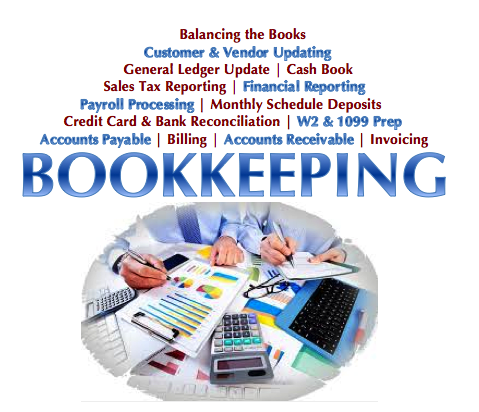

Let us help you! We specialize in catching up the books and then continuing to keep them updated. We have helped countless small business owners – sole proprietors, partnerships, LLCs, and S-corps – with their bookkeeping needs. Whether you’ve fallen behind (by a month or two or even by a whole year or two) or just don’t want to deal with the process of working on the books each month, we can help!

Being behind on your bookkeeping unfortunately means being behind on your business stance. If you are not monitoring your numbers in a visible form and generating insightful reports, you could definitely find yourself out of cash flow and ultimately out of business.

We provide services on and off-site to clients in the New York metropolitan region, and remotely in all other geographical areas of the continental US. We assist small to mid-sized businesses across industries.

Most small business owners are surprised to discover that our bookkeeping service packages are extremely cost-effective and our services actually lead to increased profits, reduced taxes, and improved cash flow – not to mention fewer headaches and more time for doing things you love and more hours you can use to focus on growing your business.

Don’t wait another day to address the bookkeeping matters that keep you up at night – give us a call today or schedule a free consultation and let’s get started.

We will help you fall in love with your small business all over again!

by Eugénie M. Nugent | Mar 10, 2016 | Business Tips, Financial Reports

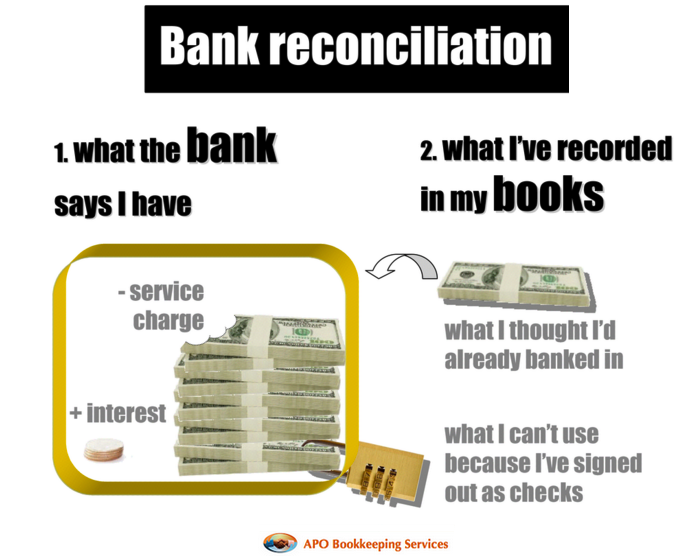

Photo courtesy of APO Bookkeeping

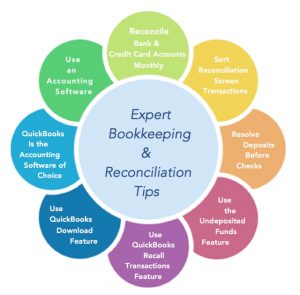

Reconciling all your accounts on a monthly basis is the single most important thing you could do for yourself and your business. There are numerous software available to help make this process effortless, but regardless of the software or lack thereof, monthly reconciliations must be done in order to avoid costly mistakes.

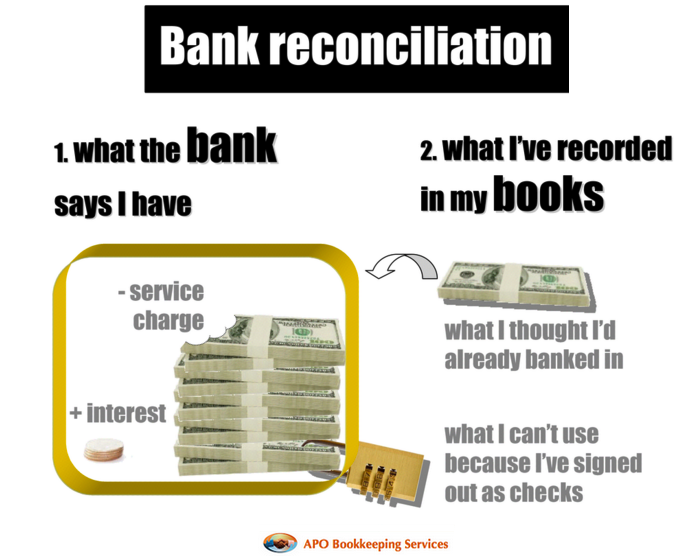

Why reconciling your accounts is so important

Reconciliation is so important because it is the only way to be certain your account balances are in agreement with your financial institutions, vendors, etc. Reconciling your accounts ensures that the actual monies spent matches the monies leaving an account at the end of a period, and that the actual monies put in also matches the monies coming into an account at the end of a period. When you reconcile your bank statement every month with your QuickBooks balance for example, you will become aware of checks that have not been cleared, and this will help you track down any potential missing payments. You will also become aware of any deposits you have made that are not showing up. This is rare, but it does happen! In addition, you can use your reconciliation statement to make sure your other company transactions are going through and have been calculated for the proper amounts.

There are aspects of your financials that reconciliation will not take care of such as personal monies you used up for the business, but have not recorded, as well as other assets and liabilities that may not have affected your reconciliations. So, reconciliations alone will not make your “books” accurate. You may need the help of a bookkeeper and CPA to get these aspects worked out; bookkeeper to ensure everything is recorded, and the CPA to analyze what is recorded and make the final call on whether the entries make the final books better or worse for the business.

It is imperative that controls – checks and balances, are in place to monitor the business banking and credit card transactions. For large firms you should have multiple hands assigned to cross-checking banking activities on a regular basis. For small businesses, you the owner should check your banking transactions – at least on a monthly basis to ensure everything is on par – even though you may have someone assigned to reconcile your accounts. When bank statements are not monitored and reconciled, the potential for undetected loss is high. Not all employees or accounting firms are honest, and you may not miss money that has been taken for some time. This is the reason some employees are able to embezzle hundreds if not thousands of dollars over time. Reconciling your bank statement helps you prevent losses and may indicate a potential problem in your accounting system.

What accounts can be reconciled and how to reconcile them

Any account that you get a statement for, showing a beginning and ending balance, can and should be reconciled. This includes: bank accounts, credit card accounts, loans and lines of credit accounts, and vendor accounts. There is also the internal reconciliation of many accounts, including customer receivables accounts.

Reconciling any account in software such as QuickBooks is a moderately easy feat. The time it takes to reconcile your accounts will depend on the accuracy of the transactions entered in your accounting system; if they were entered correctly – precise numbers and debit/credit accounted, your reconciliation should be done in a shorter time. If however they were not carefully entered, it may take you a longer period of time trying to locate the discrepancies. If this is the case, you may need to go transaction by transaction verifying your bank statement numbers with QuickBooks and marking each cleared as you go along. This can be tedious if there are many transactions; however, it must be done. You can see why it is vital to enter all transactions accurately to begin with. If you are using QuickBooks or other similar software, you should take advantage of the “download” feature. Initially, you will need to edit and select the right accounts as well as input the vendor or customer before you add or match each transaction; however, QuickBooks will begin to recognize each transactions that you have edited after a while and most importantly your numbers will be accurate with the correct corresponding debit or credit.

Using the ask my accountant account for questionable transactions

QuickBooks has a “Ask My Accountant” option in their chart of accounts that can be a huge ally in helping you reconcile. At times you may have transactions that you are not sure how to enter, or how to enter to be beneficial to your business. Any questionable transactions should be coded to “Ask My Accountant” so that you can continue with your reconciliations while having a conspicuous account to house them and have them easily accessed and rectified at a later date by your CPA.

So, reconcile your accounts on a monthly basis! You want to ensure that all the transactions are in your ledger and accurately accounted for. It is easy to forget to enter an expense or a payment when you are in a rush or if you have misplaced a receipt, so cross-checking against the account statement can be a good safety net for your own books. Doing so will ensure that you are getting paid—and paying people back—promptly, which in turn will help you keep other parts of your accounting in order such as your cash flow, profit and loss statement, etc. Of course you can trust your suppliers and creditors to charge appropriately, but everyone makes mistakes and are prone to err.

How to Reconcile Your Monthly Bank Statements With Your Bank Balance in QuickBooks

How to Reconcile Your Monthly Bank Statements With Your Bank Balance in QuickBooks

How to Clear Items from the Make Deposit Window in QuickBooks for Past Period that Was Already Reconciled

How to Clear Items from the Make Deposit Window in QuickBooks for Past Period that Was Already Reconciled

How to Reconcile Your Paypal Account With QuickBooks

How to Reconcile Your Paypal Account With QuickBooks

by Eugénie M. Nugent | Oct 29, 2015 | Business Improvement, Business Tips

Photo courtesy of APO Bookkeeping

For any number of reasons, you may opt to do your bookkeeping on your own instead of hiring a bookkeeper in-house or outsourcing your bookkeeping. Like many things, there are advantages and disadvantages to doing your own bookkeeping, but with some basic accounting knowledge and a keen eye for detail you should be able to pull it off. Here are a few tips to help you as you do it on your own:

Use the Right Accounting System

Use the Right Accounting System

Accounting is either cash-based, or accrual-based. With the cash method, you count the income when you receive it, and expenses when you pay them. Under the accrual method, you count income and expenses when they happen, and not when you actually receive or pay them – respectively. The other main difference between the two methods is the ability to budget accurately. Accrual method of accounting allows for better budgeting and planning because it looks at when liabilities are incurred and revenue earned and not when cash is paid. This method puts on the books liabilities that might otherwise be forgotten, like accrued interest. The cash method does not take accrued interest into account until it is required to be paid. This could put a strain on a small business that did not plan to pay out accrued interest balance, and is now faced with cutting expenses in other areas to have enough cash to pay the outstanding balance. The two methods have their advantages as well as disadvantages, and as far as filing taxes, the IRS only requirement is that you use the accrual-based system if your annual sales is more than $5 million or you store inventory.

Record transactions as soon as they occur

Record transactions as soon as they occur

If you are using spreadsheets for your bookkeeping, or doing it manually on paper, you need to record your transactions as soon as they occur. If you are using an accounting software such as QuickBooks, you need to decide whether you will be recording transactions as they happen or adding them via the bank downloads later. Regardless of the method you use, keep your books updated at all times. Doing so will allow for little to no discrepancies, better workflow, and you will also have updated information on which to rely for decision making.

Record all business transactions

Record all business transactions

In order to have accurate numbers from which to make good business decisions, and file correct tax returns, you need to ensure all numbers affecting the business is accounted for and recorded. For example, if you are a business owner who sometimes uses personal funds for business expenses – and vice versa, you need to include those numbers in your bottom line.

Track Reimbursable Expenses

Track Reimbursable Expenses

As a Small Business owner, it is very likely to sometimes use your personal funds to for pay business expenses. These monies should be reimbursed to you as well as recorded in the company’s expenses, and so there should be an account created to keep track of these reimbursables. Also, if your employees are construction workers or engineers who are usually in the fields and may use their funds to make small purchases that are immediately needed in order to continue their work, you need to collect those receipts and add them to the reimbursable account from which you will later repay them. Doing this is also important for accurate job costing.

Keep Accounts Categorization Simple

Keep Accounts Categorization Simple

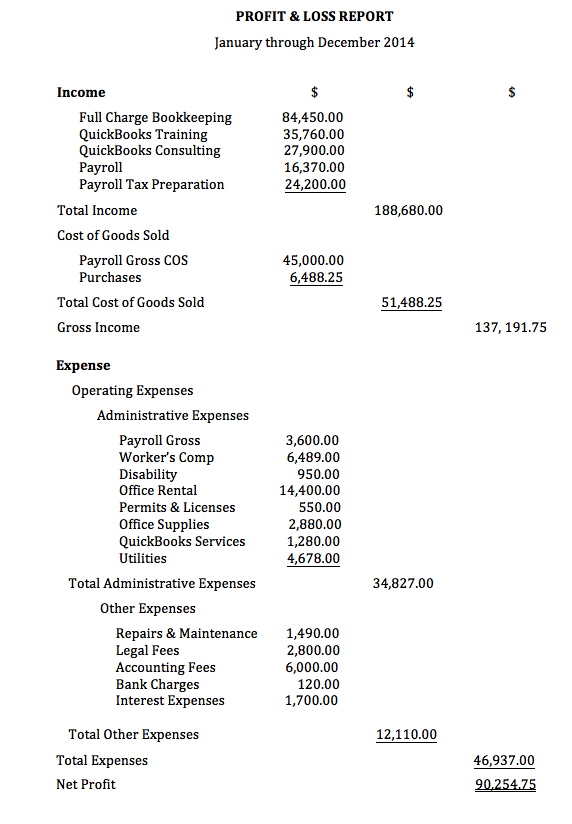

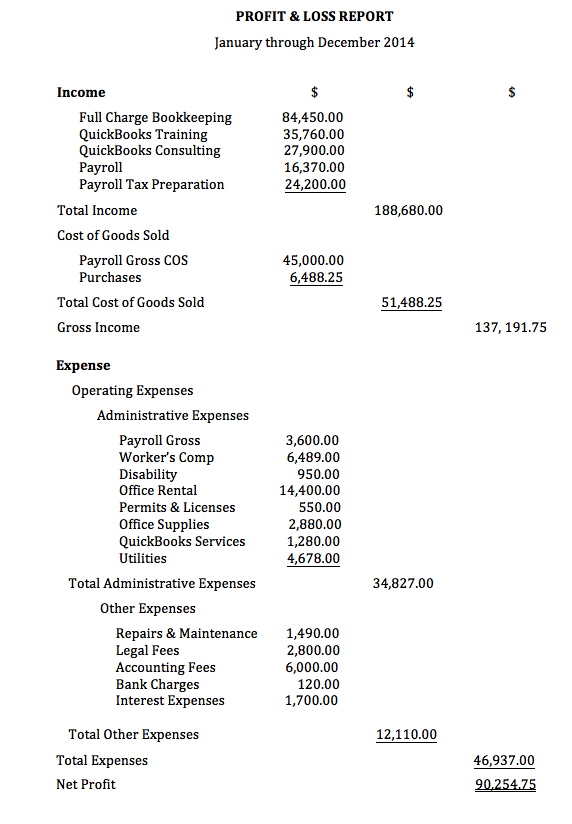

Overcategorization leads to miscategorization and ultimately inaccurate reporting. As a small business, you should be able to categorize your accounts in three to four sections:

1) Income – under which you can create subaccounts of your various streams of income

2) Cost of Goods Sold or Cost of Sales – under which you can create sub accounts for the employees salaries who are directly involved in the creation of the products you sell or the services you offer, as well as the products purchased to be used in the creation of your complete product for sale.

3) Operating Expenses – under which you can create a subaccount for Administrative Expenses and further subaccounts under Administrative expenses to list those individual accounts.

4) Other Expenses – under which you can create subaccounts to list other expenses that do not fall under any of the above categories.

The balance sheet accounts are usually fairly standard with three main sections: 1) Assets, 2) Liabilities, and 3) Equity each with their own subaccounts. You will need to create additional accounts on as needed basis. For example, if you loan money to your company, you will need to create a liability account to record these amounts the company owes you. Likewise if you borrow money from your company, you will need to create an asset account to reflect this.

Here is an example of a Simple Profit & Loss Report or Income Statement:

Deduct Sales Tax from Total Sales

Deduct Sales Tax from Total Sales

If you are a retail business that collect sales tax on behalf of the government, you should deduct these sales taxes from your sales. If you are using a software such as QuickBooks for your bookkeeping, and you do not track inventory in QuickBooks, you can setup this account as an Income account and set it as a discount so that it will be listed at the top of your Profit and Loss report and lessen from the total sales. Also, avoid penalties and interests and pay over your sales taxes as soon as they are due.

Keep Proper Records of Loans Received

Keep Proper Records of Loans Received

Many small business owners need financial backing at their startup, and may take out a loan or two. These loans must be recorded and tracked in separate accounts, paying special attention to separating the principal repayment and the interest payment. The interest is an expense to your company and should be recorded in the expense section of your income statement or profit and loss report, while the principal is made towards your loan balance which will be in your liability section of your balance sheet.

Use Checks or Credit/Debit Cards Instead of Cash

Use Checks or Credit/Debit Cards Instead of Cash

Cash makes it harder to keep track of spending. Misplaced receipts, forgetting to document purchases all can be avoided if checks or debit/credit card payments are made. Not only will you have the amounts available to record, but you will also have details on uses of funds.

Reconcile all Business Bank & Credit Card accounts every month

Reconcile all Business Bank & Credit Card accounts every month

This is one of the best business practices to employ! Reconciliation is a fundamental aspect of bookkeeping. Not only will you be able to catch any mishaps that occur; it will spread your workload and keep your books up-to-date-and accurate. Also, any mistakes on the bank’s or credit card company’s part that are not caught within six months, will not be able to be resolved. If you look on your statements, you will see that the banks include a reconciliation sheet and recommends that you reconcile your numbers with theirs. Reconciliation is the only way to ensure your numbers are accurate and your bookkeeping on par.

Let Payroll Specialists Handle Your Payroll

Let Payroll Specialists Handle Your Payroll

Payroll and payroll taxes can be complicated/intricate and not only do you need to ensure your employees paychecks are precise, but you must make correct payroll deposits as well as file accurate taxes. Payroll specialists are trained especially for this, and so they know the ins and outs, and are fully equipped to get this done accurately.

Keep a Proper Filing System in place

Keep a Proper Filing System in place

Not only is this good business practice, but you do not want to drive yourself crazy trying to find one document that is urgently needed – pronto. As a “do-it-yourselfer” it will greatly benefit you to keep a proper filing system where you will file all documents and paperwork in a manner that makes them easily retrievable.

Keep an Eye on Your Cash Flow

Keep an Eye on Your Cash Flow

Cash is King for any business, and the lack of it is the reason so many small businesses fail. Know how much it takes to keep your business running on a monthly basis! Devise an accurate system of expenses and monthly obligations, and weigh them against your reliable monthly inflow of cash. Include an extra 20% of total expenses to your expenses for a bit of “cushion”. A budget and forecast report is a huge plus to create, maintain, and use as a financial guide.

Give Your Customers Options to Pay You

Give Your Customers Options to Pay You

Providing your customers with a variety of payment options will not only make your customers happy as far as convenience, but it will allow you to get paid more quickly. In today’s fast paced world, convenience goes a long way! Some customers may procrastinate writing that check AND mailing it, or setting up that online bill pay. Allowing them the option to pay you via your submitted invoices will be a huge plus in helping your cash flow.

Invoice Customers on Time

Invoice Customers on Time

The sooner you bill your customers the sooner you will get paid, and that will also help keep your cash flow up and your budget on track.

Pay Bills on Time

Pay Bills on Time

Pay attention to those vendors who are sacking a late payment fee to late payers. Take advantage of those terms of payments you get, but make every effort to meet them. The delay will help with your cash flow, but may accrue interest if not paid on time.

Have your vendors submit a completed and signed W9 form

Have your vendors submit a completed and signed W9 form

For vendors to whom you have paid a minimum of $600 and above during the year who are not a corporation, you will need to report their payments to the IRS on from 1099-Misc at the end of the year. You will need specific information from them to include on this form such as their mailing address and tax identification number. It is best to keep W9 forms on hand, so that you can have your vendors complete them at the time you realize that the monies you are paying them are at this threshold. You should check your vendor balances to see if the monies you have paid them are amounting to $600 and above, as you may often write a check for under six hundred but may make more payments to them amounting to $600 and above throughout the entire year. Waiting for year-end to collect this information may be a daunting task, which many times – from my experience, has proven futile. You cannot file form 1099 without the vendors tax identification numbers, and of course you will need to mail their copies to them. If you pay your vendors through a Payment Portal such as Paypal or with your credit card, you will not be required to file or include those amounts on your 1099 as these companies are already reporting them on their 1099k.

Backup Your Computerized Information

Backup Your Computerized Information

Computerized systems as well as software do fail at times, and it would be devastating if all the work you have put in to your system were to become corrupt beyond repair, or inaccessible. Portable Hard Drives like this Toshiba Canvio Connect II 1TB Portable Hard Drive or this Seagate Backup Plus Slim 2TB Portable External Hard Drive with Mobile Device Backup USB 3.0

or this Seagate Backup Plus Slim 2TB Portable External Hard Drive with Mobile Device Backup USB 3.0  will store a copy of your information for easy retrieval, and save you the headache of ever losing your information that you have worked so hard at compiling.

will store a copy of your information for easy retrieval, and save you the headache of ever losing your information that you have worked so hard at compiling.

Leave an Audit Trail

Leave an Audit Trail

If you have a system that allows you to quickly and easily retrace your company’s financial activities, your record keeping is effective. This includes keeping your invoices and checks in numeric order, not skipping check or invoice numbers, and keeping bank and credit card accounts separate. You should be able to retrace a year or years and have a clear trail of your company’s financial activities.

The best way to work as a “do it yourselfer” and not be overwhelmed, is to always keep every area of the business up-to-date. Designate a time to get the tasks that can be done later such as recording reimbursables and paying bills, and do the ones that cannot wait – such as Invoicing and attending to your customers first. Create a monthly chart with a daily workflow that you will be able to model everyday, and stick with it.