by Eugénie M. Nugent | Aug 16, 2016 | Business Improvement, Financial Reports

Backed Up Bookkeeping Update

Are you a small business owner trying to manage all aspects of your business on your own?

Have you fallen behind with your bookkeeping?

Do you find that your bookkeeping tasks are taking the passion out of your business?

Do you pull your hair out every time you think about keeping the books? (Well, not literally, I hope)

Let us help you! We specialize in catching up the books and then continuing to keep them updated. We have helped countless small business owners – sole proprietors, partnerships, LLCs, and S-corps – with their bookkeeping needs. Whether you’ve fallen behind (by a month or two or even by a whole year or two) or just don’t want to deal with the process of working on the books each month, we can help!

Being behind on your bookkeeping unfortunately means being behind on your business stance. If you are not monitoring your numbers in a visible form and generating insightful reports, you could definitely find yourself out of cash flow and ultimately out of business.

We provide services on and off-site to clients in the New York metropolitan region, and remotely in all other geographical areas of the continental US. We assist small to mid-sized businesses across industries.

Most small business owners are surprised to discover that our bookkeeping service packages are extremely cost-effective and our services actually lead to increased profits, reduced taxes, and improved cash flow – not to mention fewer headaches and more time for doing things you love and more hours you can use to focus on growing your business.

Don’t wait another day to address the bookkeeping matters that keep you up at night – give us a call today or schedule a free consultation and let’s get started.

We will help you fall in love with your small business all over again!

by Eugénie M. Nugent | Feb 28, 2015 | Business Tips, Financial Reports

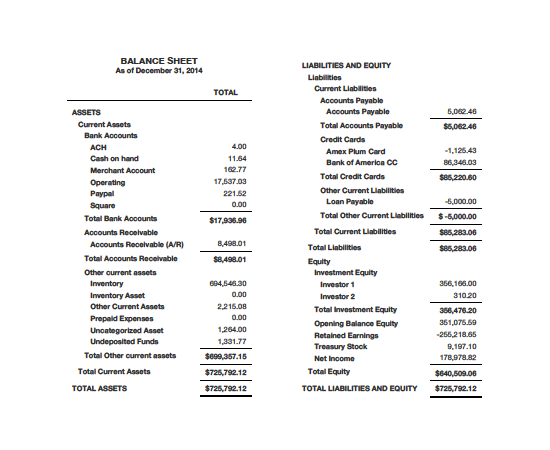

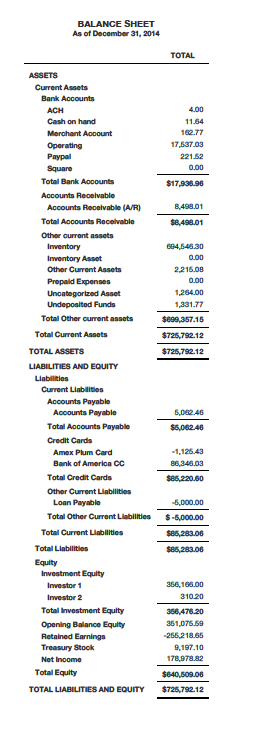

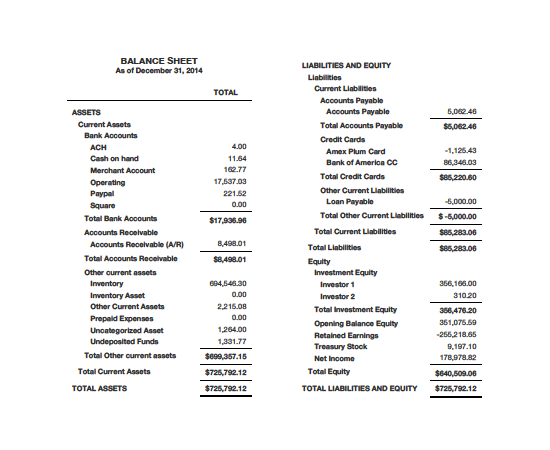

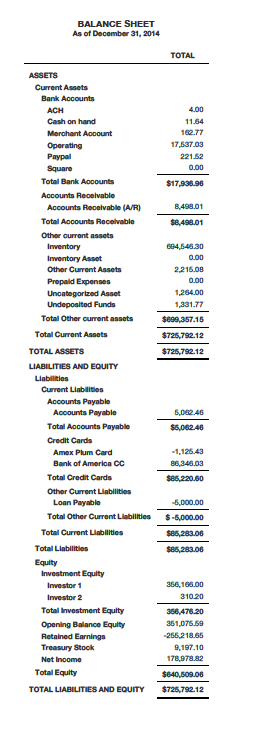

Balance Sheet Example

- Assets

- Liabilities

- Equities

1) Assets – What You Own

Balance sheets usually start with cash balances that include monies presently in your bank account(s) as well as your petty cash till, minus checks you may have written but are not yet presented to your bank to be cashed. Those outstanding checks would reduce your account balance(s) once they are cashed. Monies in your Paypal, Square or any other ecommerce portals that allow you to receive payments are also shown in this section of your balance sheet.

If customers owe you money that you have invoiced for but not yet received, you will see those outstanding amounts in Accounts Receivable on your balance sheet.

If you sell products, the cost of all of them that you have purchased and not yet sold will be in the Inventory Asset account.

If you own equipment, furniture, vehicle or something similar that lasts for years, you will have a balance in Fixed Assets for what you paid for these items. If it has been a while since you have owned them, you may have a Depreciation account, and when you net the two, your Fixed Asset values are reduced.

All of the above are assets and they are listed in the first section of a balance sheet.

2) Liabilities – What You Owe

If you owe money for taxes, to vendors, or to employees, then it will show in the Liabilities section, which is the second of three major sections of a balance sheet. Day to day unpaid bills are in an account called Accounts Payable, and separate accounts are usually set up to document monies owing for taxes, etc.

If you have bank loans, they usually each have a separate account like a bank account does. Each bank loan account represents the principal due on a loan (the interest you pay is recorded in the expense section of the P & L).

3) Equities – All Monies You have Invested In Your Business Plus/Minus Its Income or Loss

The final section of the balance sheet is the Owner Equities. It is the section that will vary the most depending on the type of entity your business is set up as. For example, if your business is a corporation, there will be a common stock account that will represent the original amount of money you put into the business. It will match the Articles of Incorporation that you drew up when you incorporated. This amount will rarely ever change for the life of the business.

Also, there is usually an account called Paid-in Capital which is how much additional money you have put in or taken out of the company beyond the common stock balance.

A corporation will also have a Retained Earnings account. This reflects accumulated profit (or loss) through the years of operation.

If your business is set up as a partnership, the equity section will include an account for each partner that represents their balance in the firm, which is the net amount of money they have put into the business over the years minus the amount they have withdrawn as well as plus or minus the business income or loss through the years.

Unlike the Profit and Loss or Income Statement accounts that are zeroed out at the end of each accounting period, the balance sheet accounts accumulate continuously and does not clear out at the end of each accounting period or year. Thus, the P & L or Income Statement report can be generated using specified date range while the Balance Sheet report can only be generated as at a particular ending date and not by range of dates.